indiana real estate taxes

Property Reports and Tax Payments. Corrections Indiana Department of.

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Choose from the options below.

. Tax amount varies by county. You will receive a statement with upcoming due dates in the Spring. The information provided in these databases is public record and available through public information requests.

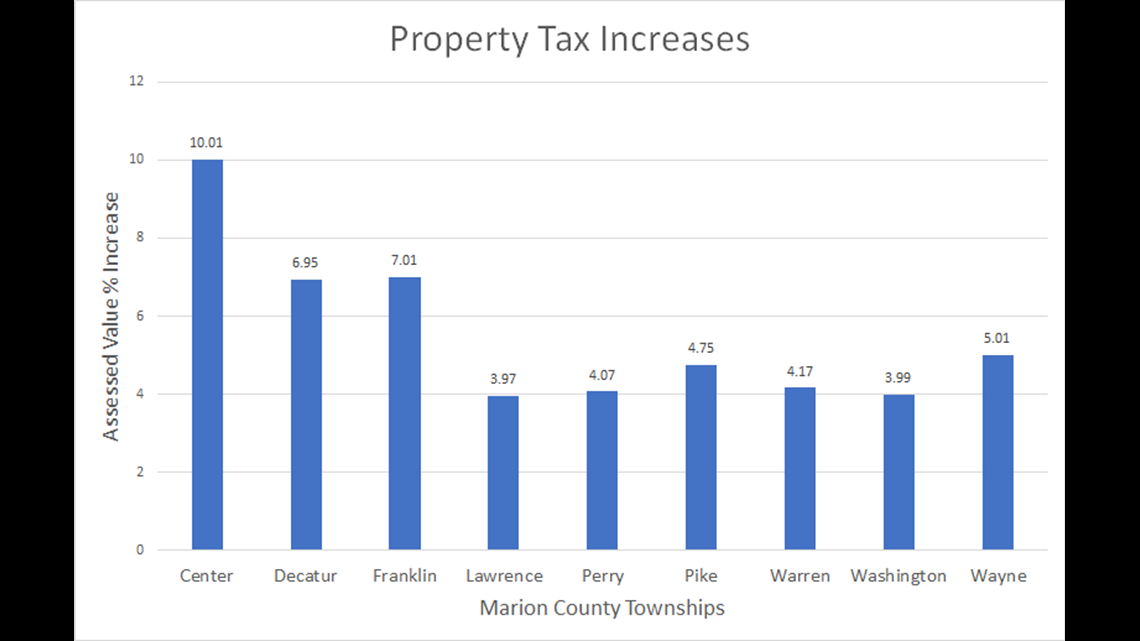

Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must. Tax deadline for 2020 realpersonal taxes. Use this application to.

Criminal Justice Institute. Welcome to the St. Our staff is equally devoted to achieving our goal of fair and.

Dial these numbers in case of any emergency. Make and view Tax Payments get current Balance Due. Property taxes are due twice a year.

The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000. In fact the average annual property tax paid in Indiana is just 1263. 2019 pay 2020 property taxes are due May 11 2020 and November 10 2020.

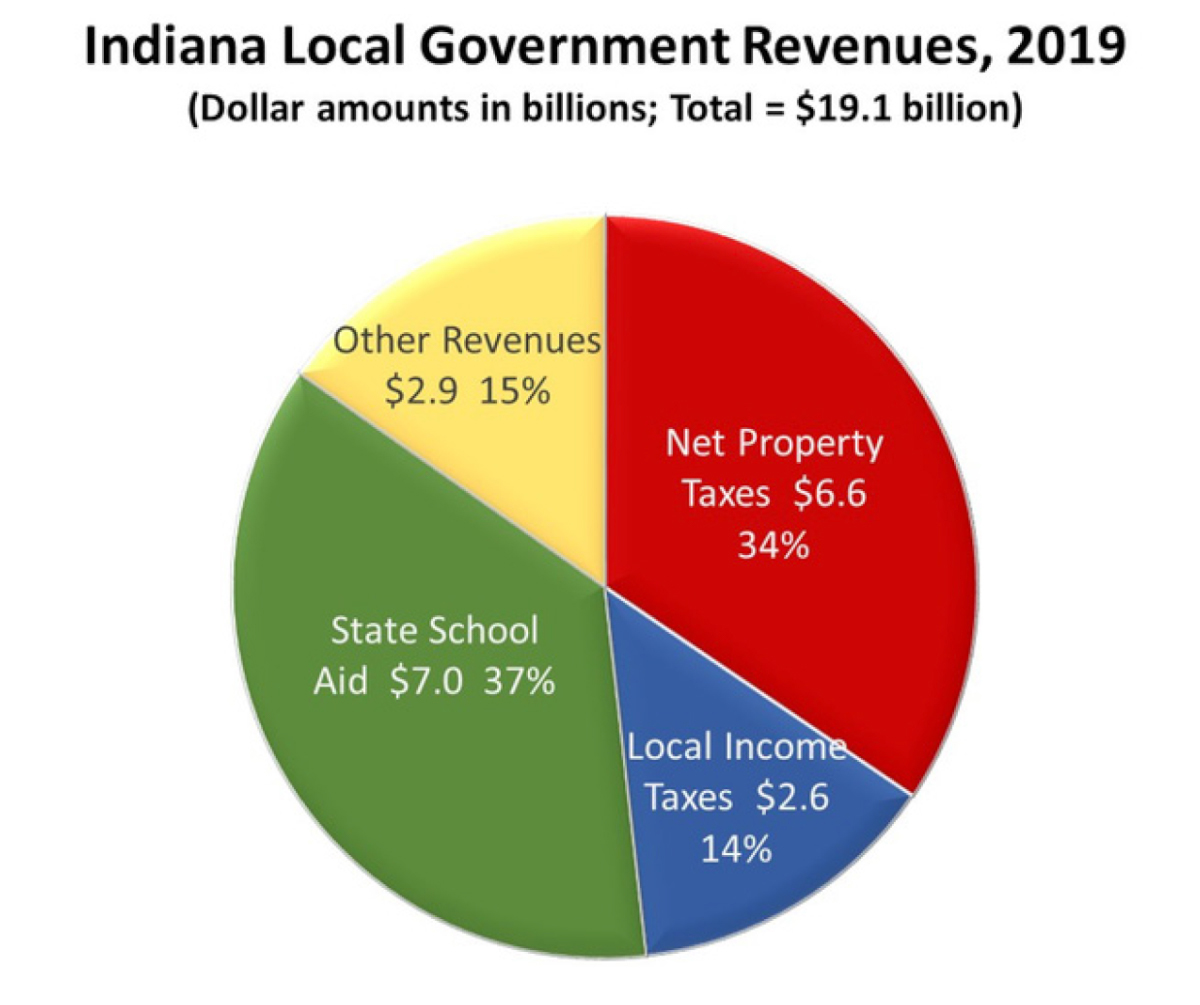

Pay Your Property Taxes. Indiana has relatively low property taxes. Indiana communities rely on the real estate tax to fund governmental services.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. In Carmel Indiana the property tax rate is 1078 of the assessed value of the property. Indiana hasnt released the amount at the time of this writing but the current amount is either 60 of your propertys assessed value or a maximum of 45000 whichever.

Visit the Clark County Property Tax Assessment Website. Job in Indianapolis - Marion County - IN Indiana - USA 46262. Homeland Security Department of.

The Department of Local Government Finance has. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. View and print Tax Statements and Comparison Reports.

Property tax increase limits. Manager of Personal Property Tax. You can search the propertyproperties by.

Enter your last name first initial. Joseph County Tax research information. State Excise Police Indiana.

If you have an account or would like to create one or if you. Statements are mailed one time with a Spring A coupon and Fall B. Please direct all questions and form requests to the above agency.

This is around half the national average. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes. It typically accounts for the largest segment of the general revenue fund in these municipalities.

Current property tax due dates are. Law Enforcement Academy Indiana. Counties in Indiana collect an average of 085.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. The amount youll pay. Please direct all questions and form requests to the above agency.

155 Indiana Avenue Valparaiso. The assessed value of a property is determined by the county assessor and is equal. Property taxes are an ad valorem tax meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayers property.

State Lawmakers Eye Business Tax Cuts Indianapolis Business Journal

Save Money By Filing For Your Homestead And Mortgage Exemptions

Property Tax Rates Across The State

Marion County Indiana Property Tax Appeal

Citizen S Guide To Property Taxes

Considering Relocating To Jasper Indiana Has Low Property Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide

Living In Northwest Indiana Low Property Tax New Development

Are There Any States With No Property Tax In 2022 Free Investor Guide

Threats To Local Government Revenues From The Coronavirus Recession Purdue Ag Econ

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

Pay Your Property Taxes Or View Current Tax Bill

Indiana Property Taxes Mainstay Basics Youtube