riverside county sales tax 2020

The Riverside County sales tax rate is. Welcome to the Riverside County Property Tax Portal.

Corona Business News September October

These properties may be purchased at one of our many online public auctions.

. Some cities and local. Please check back soon for information on Riverside Countys next tax-defaulted properties sale on Bid4Assets. 1788 rows Riverside.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Riverside California is. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county.

The California state sales tax rate is currently. The Riverside County Sales Tax is 025. The Riverside County Treasurer Tax-Collector will be postponing 25 parcels from this sale to Thursday July 16 2020 beginning at 800 am through July 21 2020 and closing at.

075 lower than the maximum sales tax in CA. The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax. The December 2020 total local sales tax rate was also 8750.

Riverside County California Tax Sale Information. And they are proposing an additional half-cent sales tax that Michael Blomquist toll program director said would raise 88 billion in 2020 dollars countywide and 67 billion. Assessor-County Clerk-Recorder Peter Aldana announced today that the taxable value of all property in Riverside County for the current year grew to 320 billion an 18 billion increase.

The 2018 United States Supreme Court decision. The current total local sales tax rate in Riverside County CA is 7750. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us.

Unsecured - The purpose of an Unsecured tax sale. The current total local sales tax rate in Riverside CA is 8750. The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15.

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. A county-wide sales tax rate of 025 is applicable to localities in Riverside County in addition to the 6 California sales tax. The December 2020 total local sales tax rate was also 7750.

There are no tax lien certificates or over the counter sales. This is the total of state and county sales tax rates. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone.

The California sales tax rate is currently.

Food And Sales Tax 2020 In California Heather

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Riverside County Assessor County Clerk Recorder Property Sales Report

Property Tax Calculator Estimator For Real Estate And Homes

Riverside County Office Of Economic Development

Job Opportunities Sorted By Job Title Ascending Career Opportunities

Riverside California Ca 92506 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Riverside County Ca Property Tax Search And Records Propertyshark

Riverside County Voting Guide Newsradio 600 Kogo 2022 California Election Guide

8 8 Billion Riverside County Sales Tax Takes Step Toward November 2020 Ballot Press Enterprise

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Understanding California S Sales Tax

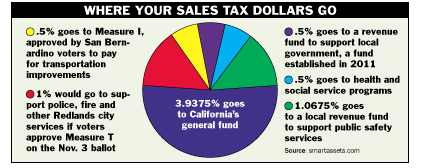

The History Of California Sales Taxes Redlandscommunitynews Com

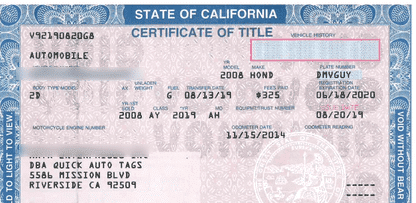

Dmv Title Transfer Quick Auto Tags The Best California Dmv Alternative

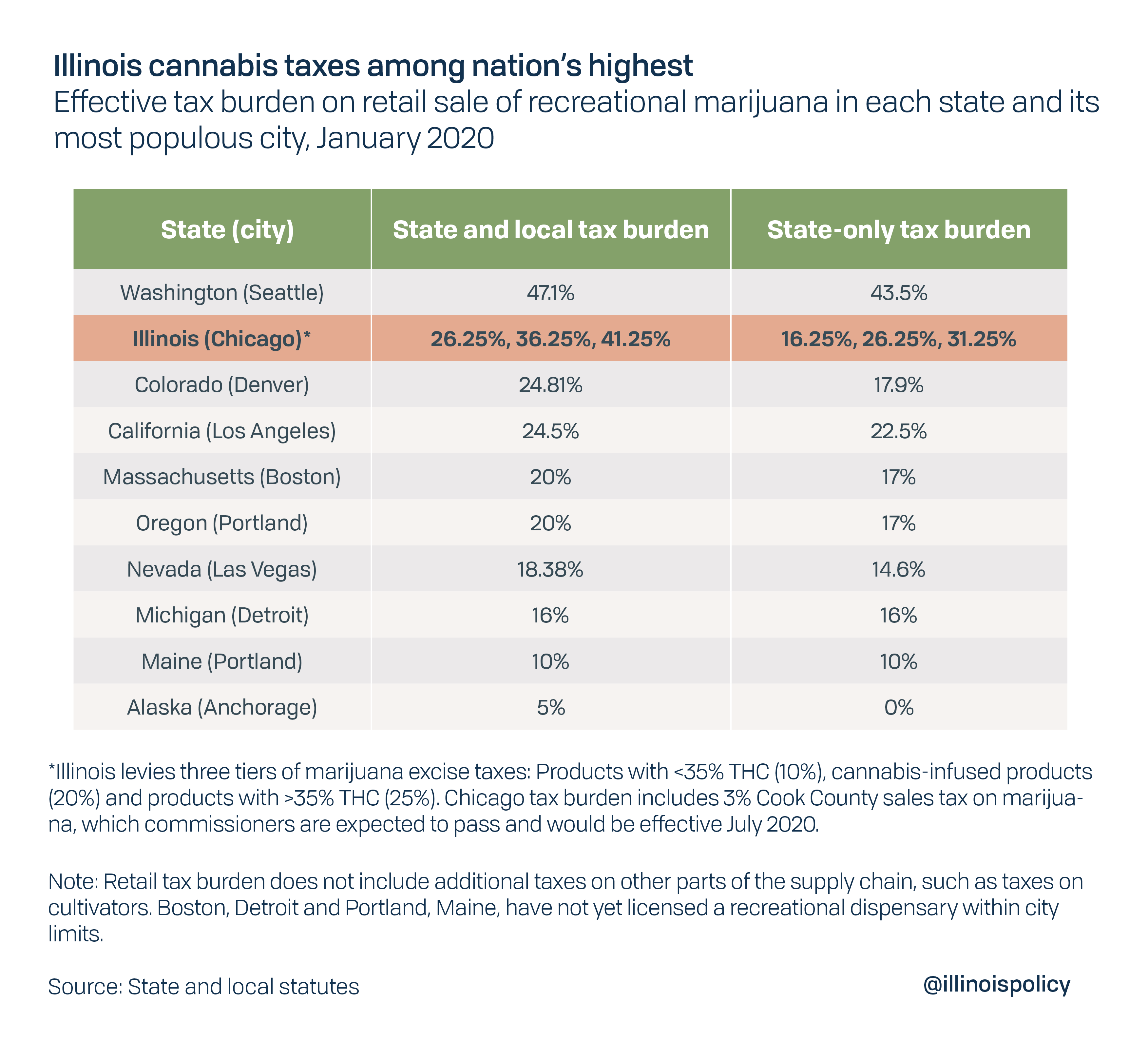

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

Riverside County Assessor County Clerk Recorder Home Page

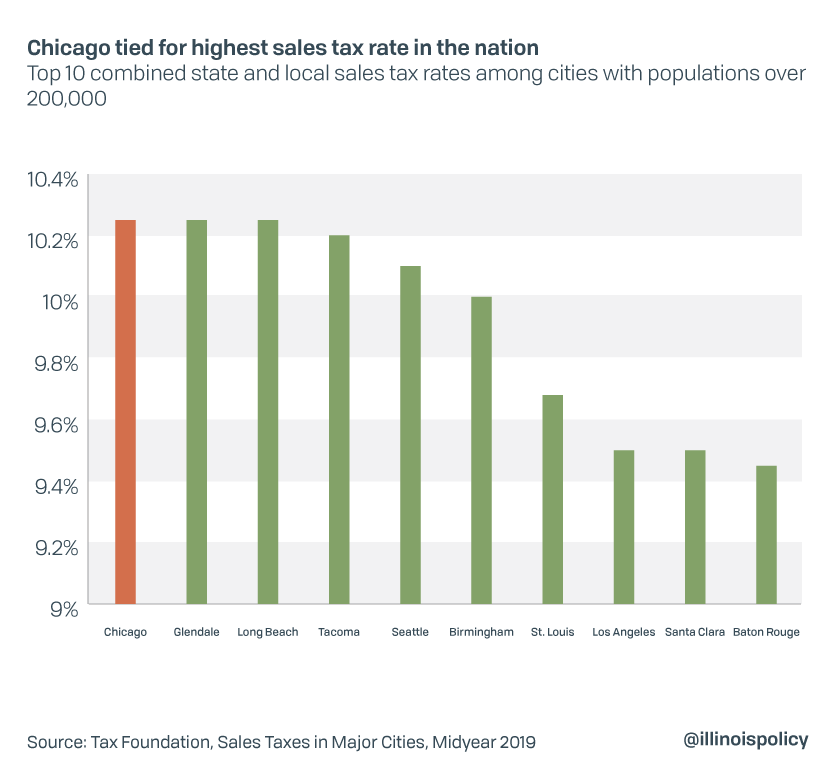

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

17811 Timberview Dr Riverside Ca 92504 Redfin

Riverside County Transportation Commission Rctc California Association Of Councils Of Governments